Robert F. Kennedy Jr. Drops $400K on 14 Bitcoins for His Kids

Democratic presidential candidate Robert Kennedy Jr. revealed he bought 14 Bitcoins for his children last May to demonstrate his support for cryptocurrency.

Democratic presidential candidate Robert Kennedy Jr. revealed he bought 14 Bitcoins for his children last May to demonstrate his support for cryptocurrency.

Bitcoin traded slightly higher around $29,300 after the widely anticipated 0.25% Fed rate hike, which had little effect on crypto or traditional markets as some altcoins rallied.

Analysts speculate BlackRock’s recommended 85% optimal Bitcoin allocation in portfolios could drive the BTC price over $190 million if adopted broadly across institutional investors.

The fitness app sMiles has launched a new location-based “Bitcoinverse” game allowing users to earn Bitcoin rewards for exploring the real world, not just for steps and shopping.

Russian President Putin has signed legislation approving the digital ruble, allowing Russia’s central bank to begin testing the central bank digital currency on August 1.

A Nevada woman was sentenced to five years in prison on Friday for attempting to hire a hitman via Bitcoin on the dark web to murder her ex-husband.

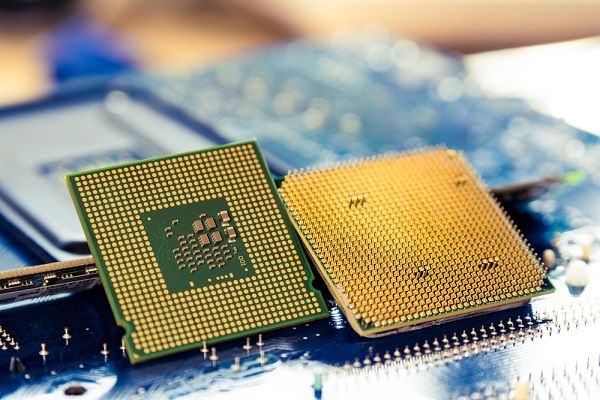

Samsung’s cutting-edge 3nm GAA chip technology has been discovered and implemented in MicroBT’s new Whatsminer M56S++ Bitcoin mining rig, marking the first confirmed real-world application of the chip one year after its release.

After briefly surging back above $30,000, Bitcoin’s price has once again dipped below this key level. BTC has failed to maintain the $30k support, causing uncertainty among traders about future upward momentum. There is currently a lack of confidence that new highs are on the horizon for Bitcoin amid its ongoing price volatility.

According to a long-term “parabolic” indicator, Litecoin and XRP could soon rally and outperform Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization.

The recent breakout of XRP above the Ichimoku cloud resistance level is seen as a positive indicator for Bitcoin’s potential to stage a similar breakout and sustain its rally, according to technical analyst Katie Stockton of Fairlead.