The purported safeguards for crypto traders pertain to tax-loss harvesting. As per the Washington Post, the White House and Republican leaders are currently in talks about prohibiting the process of cryptocurrency transactions.

Crypto tax-loss harvesting is a method employed by investors to decrease their total tax obligations. It comprises selling a cryptocurrency at a lower value to counterbalance the capital gains from cryptocurrency profits. To assert a loss, the assets must be sold, and the earnings must be utilized to procure a comparable asset within 30 days prior to or after the sale. This process is also applicable to other assets such as stocks.

The White House has proposed a plan to Republican leaders that would prevent investors from deferring taxes on real estate swaps and end tax-loss harvesting for cryptocurrency. These changes are estimated to generate approximately $40 billion in tax revenue for the US government.

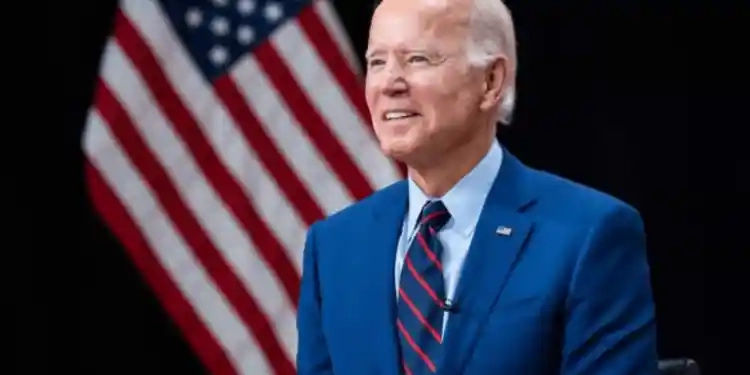

As per a source cited by the Post, the Republicans have refused to accept the proposals. House Speaker Kevin McCarthy has stated that the increase in US debt is due to excessive spending by the Biden administration during the pandemic, and not a lack of revenue. Conversely, the White House attributes the debt problem to tax cuts implemented by previous administrations, which they claim have considerably impacted revenue.

The Republicans aim to reduce the deficit by $4.8 trillion through spending cuts that would have a direct impact on the budgets of federal agencies. If Congress fails to increase the debt ceiling, the US could default as soon as June 1. During his flight from Hiroshima to Washington, D.C., Biden is expected to have a conversation with McCarthy over the phone.

Since 1917, the debt ceiling has been in place, which is the maximum amount of money that the federal government can borrow to pay its bills, as determined by Congress.