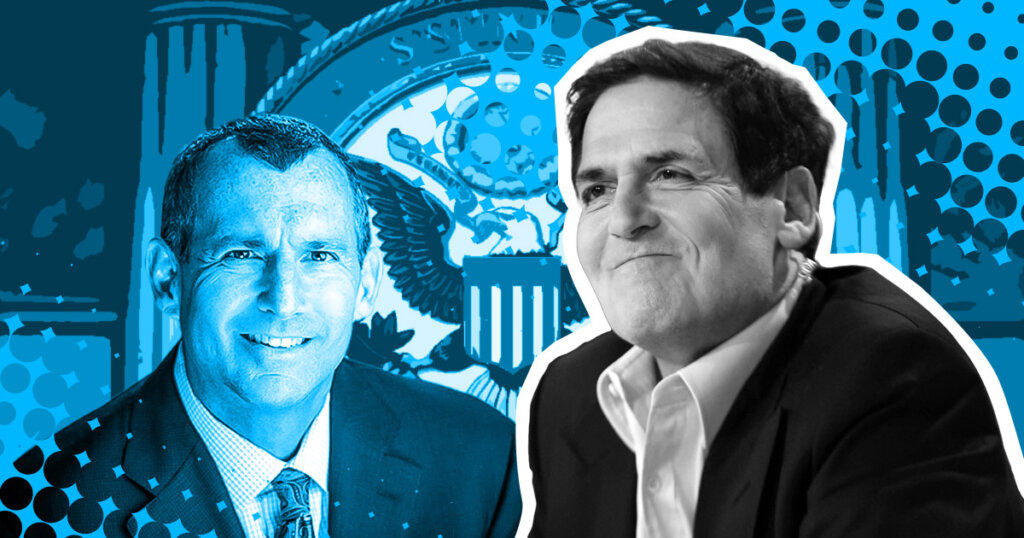

In another clash of opinions, billionaire entrepreneur Mark Cuban and former securities chief John Reed Stark have engaged in a dispute regarding the responsibility for the collapse of FTX and its consequences for creditors.

Amid a heated exchange, Cuban asserted that if the United States Securities and Exchange Commission had established definitive regulations, no one would have suffered financial losses due to the collapse.

Contrarily, Stark previously contended that cryptocurrencies, stablecoins, and even central bank digital currencies do not address any issues and that the crypto industry operates without proper regulatory supervision, consumer safeguards, and audits, among other concerns.

Mark Cuban argued that the Japanese regulatory system, which is becoming increasingly favorable towards Web3, is a good example of how to regulate the industry properly. He mentioned that nobody in FTX Japan lost any money when FTX collapsed, as opposed to investors in other parts of the world.

John Reed Stark, who is skeptical of cryptocurrencies, expressed his belief that blaming the SEC for the failures of FTX, BlockFi, Celsius, Terra, and Voyager is an exaggeration, as he considered these entities to be “dumpster fires.”

Stark acknowledged that the SEC is not always correct, but he maintains that the regulator has saved investors “millions, if not billions,” of dollars in crypto-related losses.

The former SEC official alleged that while the crypto industry has advocated for clearer regulations, it often contests the enactment of legislation and launches flashy legal challenges.

Cuban countered by advocating for “bright line investor protection regulations” as the most effective way to prevent cryptocurrency fraud. He also said,

“Anyone who doesn’t register is de-facto in violation, can’t operate, and will be shut down. That’s how you protect crypto investors.”

Stark, on the other hand, alleges that the SEC only filed charges against firms like Binance, oinbase">Coinbase, Beaxy, and Bittrex after months of the regulator warning them that they were not following regulations. He added that these companies chose to disregard the SEC’s guidance and continued to profit without registering.

This is the second instance in three weeks that Cuban and Stark have disagreed over the appropriate regulation of cryptocurrencies.

Earlier this month, Cuban criticized the SEC for not offering clear guidance on registration procedures for cryptocurrency firms. He stated that it is nearly impossible to determine what constitutes security since the SEC’s “Framework for ‘Investment Contract’ Analysis of Digital Assets” document does not provide adequate information on how cryptocurrency companies can comply with the regulations.