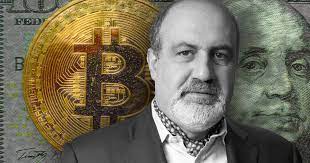

Renowned risk analyst Nassim Nicholas Taleb has issued a dire warning for itcoin">itcoin">Bitcoin as trading activity dries up. Taleb, author of the seminal book “Black Swan,” recently argued on Twitter that itcoin">Bitcoin’s eventual downfall would stem from “inexorable decay” rather than a market crash.

Taleb highlighted data showing itcoin">Bitcoin’s trading volumes collapsed 94% from March highs based on CryptoQuant figures. He contends that as volume drops, the market becomes more susceptible to manipulation.

The scholar theorized that once a fad’s popularity starts fading, even former ardent supporters begin viewing its downfall as predictable. He suggested itcoin">Bitcoin is entering this phase as interest wanes, stating “Fads are more threatened by indifference than by disgust.”

Taleb’s comments come during a conflicting time for itcoin">Bitcoin, which recently rallied 6% on a legal win by Grayscale against the SEC. Some analysts attribute recent sluggishness to a lack of catalysts rather than bearishness.

Nonetheless, Taleb likened shrinking itcoin">Bitcoin volumes to “Open Ponzis” that eventually implode. He argues the leading cryptocurrency will succumb to a gradual demise versus a sudden crash.

While Taleb strikes a dark tone, some experts counter that low volumes are expected during bear markets. However, Taleb highlights that fading interest and activity, rather than just price declines, could be an omen of irrecoverable decay for itcoin">Bitcoin if the trend continues.