Bitcoin Nears $111K Peak as Crypto Market Rally Intensifies

Bitcoin surged toward its all-time high of $111,000 while Ethereum gained 6%, driving renewed institutional interest and boosting demand for automated cryptocurrency mining services.

Bitcoin surged toward its all-time high of $111,000 while Ethereum gained 6%, driving renewed institutional interest and boosting demand for automated cryptocurrency mining services.

Robinhood’s stock has surged nearly 30% in recent weeks as the trading platform’s strategic pivot toward blockchain technology and asset tokenization drives investor enthusiasm despite regulatory challenges.

Emirates Airlines, Dubai Duty Free, and Crypto.com have formed a strategic partnership to introduce cryptocurrency payment solutions for travelers, aligning with Dubai’s vision to become a global digital commerce hub.

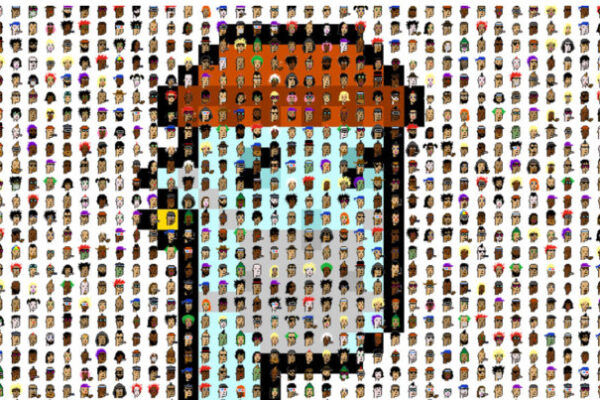

The NFT market has experienced its fifth consecutive quarterly decline, dropping 80% to $823 million in Q2 2025 from $4 billion the previous year. Despite falling trading volumes, increased sales numbers suggest a shift toward lower-priced assets and utility-focused applications.

Remixpoint CEO Takashi Tashiro will receive his entire salary in Bitcoin as part of the Tokyo-based energy company’s shift toward crypto-focused treasury management. The move aligns leadership compensation with the company’s digital asset strategy, which already includes over $116 million in cryptocurrency holdings.

Cardano (ADA) is gaining upward traction, approaching the key $0.60 resistance level as buyer interest returns. Technical indicators suggest potential for further gains if bullish momentum continues.

ElphaPex solidifies its position as a leading Dogecoin/Litecoin mining rig manufacturer with its new DG 2 series launch, targeting small-to-mid sized miners amid shifting PoW market dynamics.

NFT sales volume jumps 10% to $136.5 million this week, led by a 26% surge in CryptoPunks trading activity. The uptick signals renewed interest in blue-chip digital collectibles amid stabilizing crypto markets.

The US and China are finalizing multiple trade agreements with announcements expected in coming days, signaling potential thaw in economic relations. Key sectors include agriculture, technology, and energy.

Litecoin whales have recorded massive transaction volumes of 105.9 million LTC in a single day, setting new weekly highs amid price consolidation around $86. The surge in whale activity could signal growing institutional interest despite current market volatility.