Mt. Gox’s $9 Billion Bitcoin Payout: A Crypto Milestone

Mt. Gox, the defunct Japanese bitcoin exchange, is preparing to distribute $9 billion worth of recovered bitcoin to its creditors, marking a significant milestone in cryptocurrency history.

Mt. Gox, the defunct Japanese bitcoin exchange, is preparing to distribute $9 billion worth of recovered bitcoin to its creditors, marking a significant milestone in cryptocurrency history.

Analyst Alessio Rastani suggests XRP may experience a significant price drop based on chart patterns, identifying crucial support and resistance levels to watch. He warns of a possible return to 2020 lows unless XRP breaks through key resistance points.

USDC deposits to centralized exchanges hit a one-year high, suggesting investors are positioning to buy cryptocurrencies at lower prices. This trend, along with other market indicators, points to potential growth opportunities in the crypto market.

Tether has announced the cessation of USDT minting on EOS and Algorand blockchains, citing a strategic shift towards supporting networks with growing communities. This move follows similar actions taken last year on Bitcoin, Bitcoin Cash, and Kusama.

Bitcoin short sellers face the risk of substantial liquidations amounting to $1.67 billion if the cryptocurrency returns to the $70,000 price level, which it hasn’t seen in 12 days. Analysts suggest a major liquidation event could pave the way for Bitcoin to reach new all-time highs.

Bitcoin ETFs and crypto funds have experienced a significant downturn, with massive capital outflows since March, as investors lose confidence due to economic uncertainty and the Federal Reserve’s stance on interest rates.

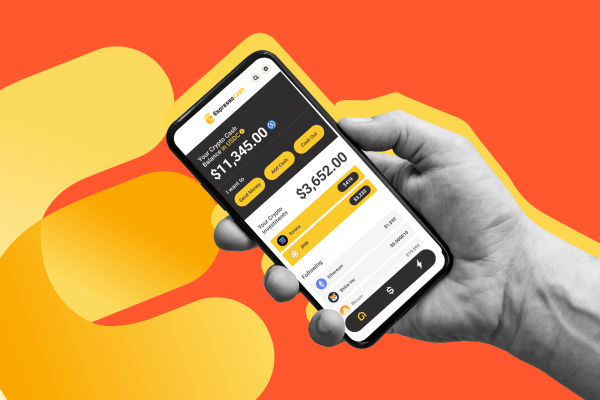

Espresso Cash now allows users to pay or request USDC stablecoin on various blockchain networks, not just Solana, bringing enhanced flexibility to USDC transactions within the DeFi space.

Cardano (ADA) and Bitcoin (BTC) are generating significant social media buzz. Cardano’s upcoming Chang hard fork and advanced governance model drive engagement—Bitcoin’s price action and market cap comparisons fuel discussions.

Despite strong demand for Bitcoin from institutional investors and long-term holders, Bitcoin’s price has yet to experience a significant rally, according to a recent report by CryptoQuant. The report cites slowing growth in the market capitalization of the stablecoin Tether (USDT) as a potential factor impeding a price rally.

Litecoin price is at a critical juncture, facing resistance from a long-standing declining trend line. A breakdown below the $100 psychological level could trigger a correction towards $90 or lower, while a breakout above the trend line could propel LTC towards $119 or higher levels.