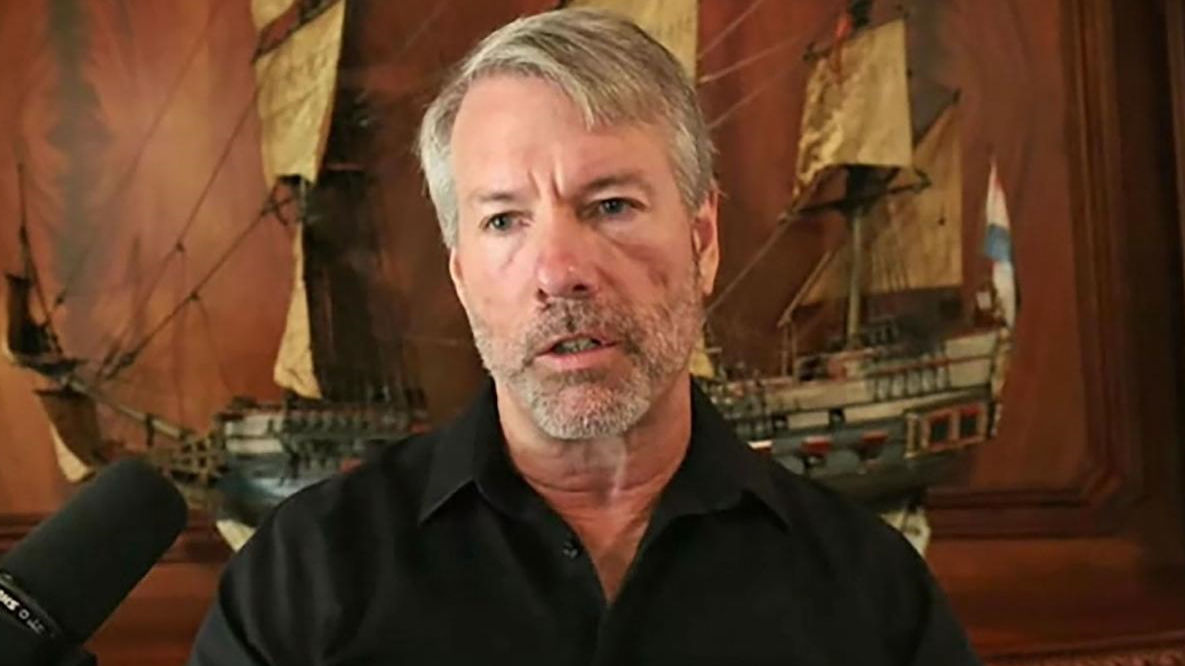

Crypto’s most fervent institutional proponent has no intention of loosening his firm’s vice grip on itcoin">Bitcoin, with MicroStrategy chief Michael Saylor proclaiming “I’m going to keep buying the top forever.”

Despite MicroStrategy’s stash of 190,000 BTC approaching a staggering unrealized profit of $4 billion based on current prices, Saylor insists trimming their position is off the table. Instead, he views the apex cryptocurrency as the ultimate portfolio parachute amidst economic turbulence.

In his characteristically hyperbolic style, Saylor trumpeted itcoin">Bitcoin’s technical superiority over assets like gold, stocks, and real estate – which all dwarf BTC’s $1 trillion capitalization. Nonetheless, he anticipates relentless capital inflows from these markets as institutions wake up to itcoin">Bitcoin’s pristine monetary properties.

MicroStrategy blazed the trail for public companies investing in crypto, making its first itcoin">Bitcoin purchase in 2020. Having acquired its holdings for an average of $31,224, the firm now sits on paper profits over 10 times higher at itcoin">Bitcoin’s latest $51,000 price tag.

Yet Saylor welcomes the ballooning appetite for itcoin">Bitcoin as validation, with surging demand from ETF products frequently outstripping newly minted supply from miners 10-fold.

While some speculate whether this intensifying hunt for scarce BTC could box out buyers like MicroStrategy, Saylor believes the rising tide will lift all boats by swelling capital flows into itcoin">Bitcoin and its ecosystem.

Rather than dampening his buying zeal, MicroStrategy’s mounting paper riches per itcoin">Bitcoin seems only to have emboldened Saylor’s messianic commitment to what he sees as the apex monetary technology.