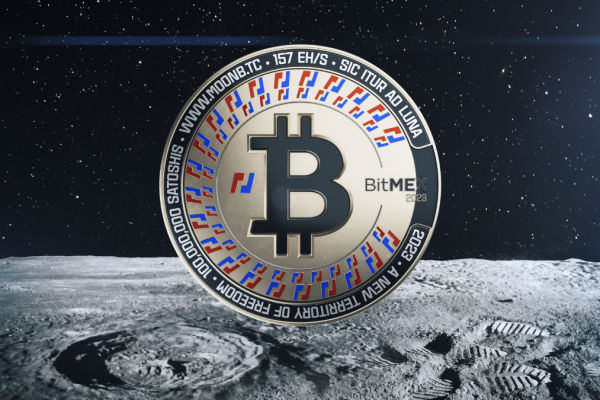

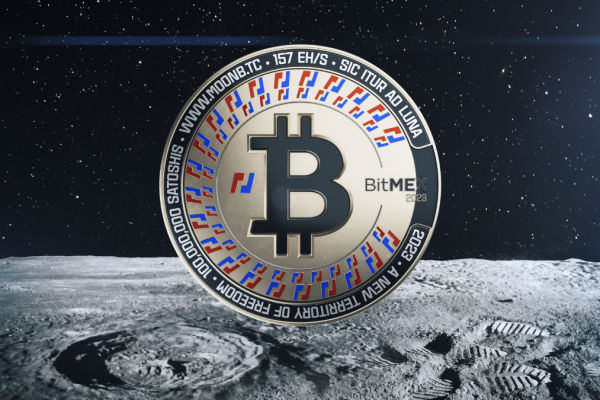

BitMEX Launching Physical Bitcoin to Lunar Surface

Crypto derivatives exchange BitMEX plans to make history by sending a physical Bitcoin token weighing 43 grams and valued at $45,000 to the moon on January 8th.

Crypto derivatives exchange BitMEX plans to make history by sending a physical Bitcoin token weighing 43 grams and valued at $45,000 to the moon on January 8th.

Major U.S. exchanges have filed amended documents for listing Bitcoin exchange-traded funds, suggesting confidence that SEC approvals are close.

Data shows the most popular topics in crypto social media revolve around the anticipation of a Bitcoin ETF approval, the latest consumer price index changes, and inflation concerns.

Investment firm VanEck has pledged to allocate 5% of potential profits from its proposed Bitcoin ETF to support core developers at Brink.

Speculation is mounting that the SEC could approve a spot Bitcoin ETF as early as Friday, fueled by viral tweets, though analysts say next week is more likely.

Bitcoin NFT sales surged to over $881 million in December 2023, shattering previous records thanks to rising interest in Ordinals and BRC-20 tokens. Data shows more buyers and sellers getting involved than ever before.

The number of installed Bitcoin ATMs worldwide dropped 11% in 2023, with the US experiencing a similar decline, while Bitcoin Depot and General Bytes emerged as industry leaders.

Jim Cramer expresses confidence in Bitcoin’s future but predicts a potential downturn post-approval of a spot Bitcoin ETF, raising skepticism among analysts.

Indonesian authorities raided and closed 10 Bitcoin mining operations accused of stealing nearly $1 million worth of electricity.

Bitcoin rose over $45k as the SEC may approve spot BTC ETFs this week. Analysts predict further upside.