“Our objective was to be able to serve FTX’s clients to offer liquidity, but the challenges are beyond our control or capacity to help,” Binance said in a statement, which was originally published by the Wall Street Journal and tweeted a short time afterwards.

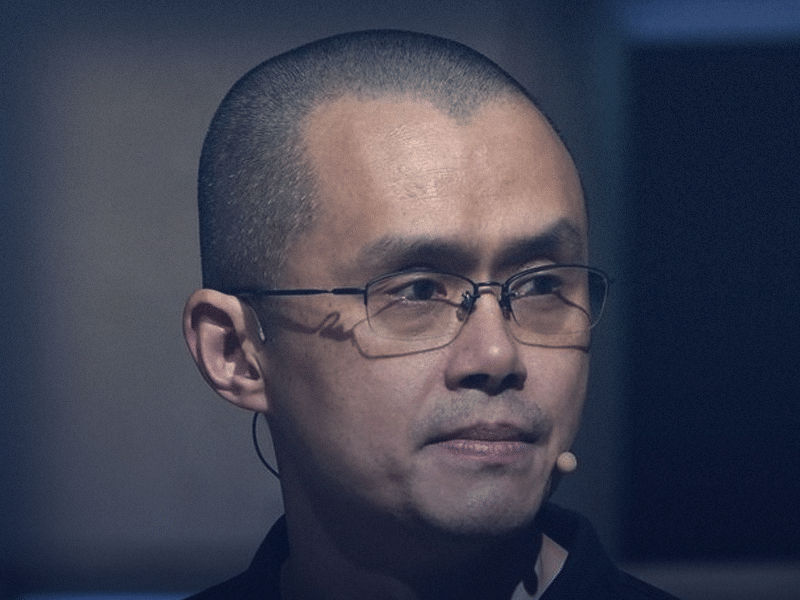

The transaction would not be finalized until the due diligence process was finished, Binance CEO Changpeng Zhao said when he made the announcement of the purchase on Tuesday.

Wednesday morning, Zhao emphasized that the acquisition had not yet been completed in a message to Binance staff that was also posted on Twitter. He instructed the Binance staff to refrain from trading FTT, the native utility token that is used to lower FTX trading fees, in the meantime.

I ordered our staff to cease selling as a team as soon as I ended the conversation with SBF yesterday,” he stated. Yes, there is a bag here. It’s fine however. What’s more, we must hold ourselves to a higher standard than even banks.

Data from CoinGecko shows that the FTT token had a day-long decline, reaching a low of $2.57, despite a small uptick after the announcement of the impending purchase. A 10% increase to $368.07 was seen in Binance Coin (BNB), FTT’s equivalent on Binance’s market, as a result of the rumored acquisition. BNB was down 20% from the previous day’s price by Wednesday afternoon, when it was trading at $288.91.

Several businesses, including Crypto.com, Tether, oinbase">Coinbase, and Genesis, have resigned from their affiliation with FTX in the last day.

The two biggest centralized cryptocurrency exchanges in the market would have merged if the transaction had been approved. According to Coingecko, as of Wednesday, Binance accounted for $49 billion and FTX for $4 billion in trading volume in the previous day, or around one-fourth of the total trading volume in cryptocurrencies.

The two CEOs and their separate firms have been working together for a long time.

Early on January 2019, Binance invested in FTX. However, FTX purchased Binance’s shares in July of last year as a result of rising pressure from authorities. In the interview with Decrypt, Bankman-Fried said, “I believe there are certain disparities between how we conduct our firms.

Zhao, however, said in an interview with Forbes that Binance’s decision to give up its stock in FTX was a result of “a regular investment cycle” that came to a mutually agreeable conclusion. Even if we are still friends, there is no longer any financial or other kind of equity in the bond.

On Sunday, Zhao used the relationship metaphor once again to explain on Twitter why Binance opted to liquidate its FTT after leaving the market a year earlier. It had a more aggressive tone this time.

We provided assistance in the past, but after divorce, we won’t pretend to be in a romantic relationship, he stated. “Nobody is in our crosshairs. However, we will not defend individuals who work behind the backs of other business players to campaign against them.

According to on-chain data, Binance started moving $584 million worth of its FTT on Saturday as part of its strategy to sell up its holdings.

FTT’s price dropped as a result. For a few of days, Bankman-Fried and his group insisted that nothing was wrong. After that, on Tuesday, Zhao and Bankman-Fried stunned the market by revealing intentions for Binance to buy FTX.