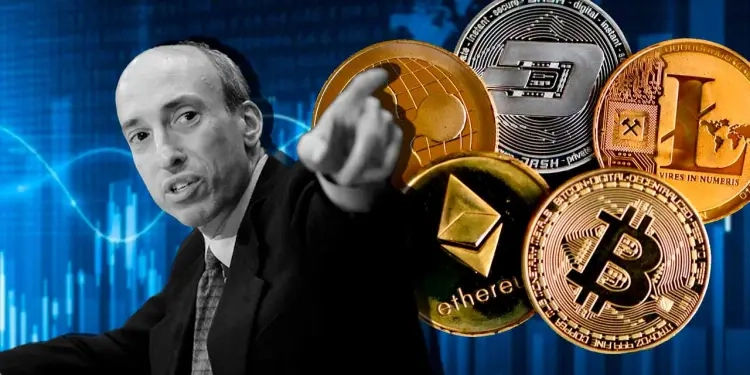

A crypto industry advocacy group for the American bitcoin sector called the Blockchain Association claimed that the U.S. Gary Gensler, chairman of the Securities and Exchange Commission (SEC), should resign from his position as an enforcer of laws governing the cryptocurrency industry, according to many who believe his public remarks have demonstrated that he is not objective in his approach to the problems.

The statement was issued as an open letter after oinbase">Coinbase filed its notice of intent on Wednesday to request a court to dismiss the regulator’s lawsuit against the company.

Jake Chervinsky, the chief policy officer of the Blockchain Association, said in the statement in reference to Gensler, “His steadfast view that all digital assets except bitcoin are securities means that he cannot approach enforcement decisions with a fair and impartial mind.”

On June 6th, the U.S. Based on claims that the oinbase">Coinbase exchange operated the trading platform as an unregistered financial securities exchange and broker, the SEC sued the exchange. A day earlier, the SEC sued Binance.US for the same allegations.

In a document, oinbase">Coinbase claimed that the SEC was well aware of the exchange’s operations involving digital assets as a result of its registration for a public offering in April 2021. Additionally, it noted that when the federal agency examined oinbase">Coinbase’s public offering registration, six of the twelve cryptocurrencies that the SEC ruled to be securities were already being traded on the platform.

According to oinbase">Coinbase’s filing, “the only change is in the SEC’s position regarding its powers. “That position is untenable as a matter of law, and its assertion through this enforcement action offends due process and the constitutional separation of powers.”

This year, the SEC expanded the legal sanctions against cryptocurrency exchanges. It imposed $30 million in penalties on U.S. cryptocurrency exchange Kraken for its crypto-staking initiatives, claiming the firm provided unregistered securities. Paxos Trust, the business that issued the Binance stablecoin, was similarly forewarned that it could face legal action. This prompted the company to stop minting the stablecoin because the SEC declared it to be an unregistered security.

oinbase">Coinbase stated in the filing that, “Rather than test its new view through notice-and-comment rulemaking, the SEC has chosen to roll out its ever-aggressive agenda through punitive retroactive enforcement actions. Agency enforcement authority is important but not boundless. The SEC’s action here is beyond those bounds and unlawful.”

While many Democrats have backed Gary Gensler in his efforts to shut down cryptocurrency exchanges, Gensler has come under fire from Republicans. On June 13, Warren Davidson, a congressman from Texas, introduced a bill called the SEC Stabilization Act that would reorganize the agency and oust Gensler as chairman.

#oinbase">Coinbase #Blockchain #SEC #Cryptonews